The invasion of Ukraine launched by Russia on 24 February 2022[1] dealt a major shock to the European economy, which was already suffering from other constraints (supply problems[2], recruitment difficulties, rising energy prices, inflation). Beyond the massive impact on the economies of the countries directly affected by the war, in particular the aggressed country itself (human losses, destruction of capital, diversion of resources from production, among others), the rise in geopolitical tensions can have economic effects even in countries not (directly) involved in the fighting. In the face of this, these countries may boost their military spending, adopt wait-and-see investment behaviour, increase precautionary savings, or suffer unanticipated shocks to import prices and capital flows (in or out). In a study available online [in French], we have attempted to quantify the effects of these ongoing tensions on GDP growth in the six economies most closely followed by the OFCE: France, the United States, the United Kingdom, Germany, Italy and Spain. In addition, we have tried to measure the impact on world trade and global industrial production.

Caldara and Iacoviello (2022) have recently proposed a quantitative indicator of geopolitical risk. The authors construct an indicator for the level of tension at the global level, which they have developed for 43 countries, including the main players on the international scene. The study also sets out the statistical method used to quantify the causal impact of the developments observed in 2022. This publication comes at just the right time for the forecaster.

2022: A historic year for international relations

For Caldara and Iacoviello (2022), geopolitical risk is associated with the impact of international crises, and more specifically with violence that affects the peaceful course of international relations. According to the authors, geopolitical risk refers to threats, or materializations of threats or the escalation of a pre-existing conflict. Such conflicts may be related to war, terrorism or any other type of tension between states or political actors. It should be noted that the term risk used by the authors for this type of phenomenon has a broad meaning that goes beyond the measurement of uncertainty or the probability that a random event will occur. The geopolitical risk index measures not only potential conflicts (which is consistent with a probabilistic definition of risk) but also conflicts that are actually taking place[3].

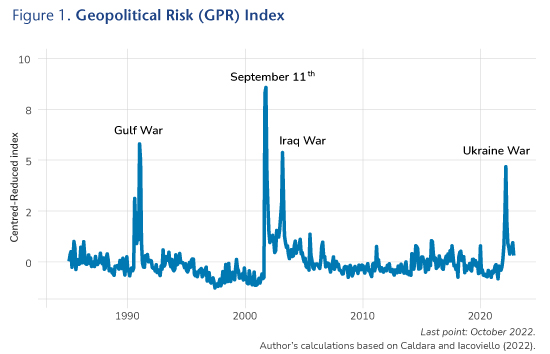

Since the 1980s, this index exhibits major changes, notably during the Gulf War, September 11th, the war in Iraq and more recently the invasion of Ukraine (see Figure 1). Moreover, between 2003 and 2022, there were occasional peaks in tension following the various terrorist attacks that took place in Europe (with France in the front line) but also in the United States, as well as other conflicts (war in Libya, for example).

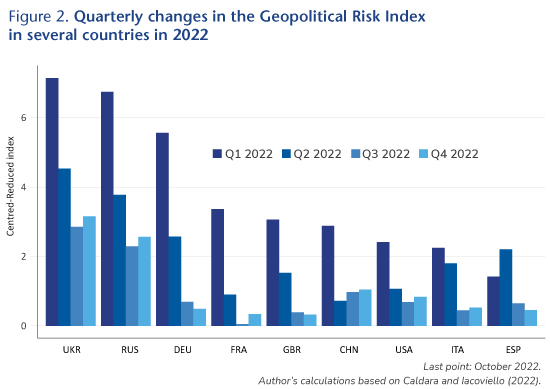

Of course, shocks do not affect all countries equally. Figure 2 shows recent changes in the geopolitical risk index in a selection of countries since the beginning of 2022. Unsurprisingly, the risk rose the most in Ukraine and Russia. In the wake of the invasion of Ukraine, geopolitical risk has risen sharply in Germany, which is especially dependent on Russian hydrocarbons. The other European countries seem – logically – more exposed to the current tensions than China and the United States.

Germany’s growth strongly affected by the rise in tension

The study estimates the responses of several economic variables (GDP, investment, interest rates, market capitalization) caused by a geopolitical risk shock[4]. In our main results, the geopolitical shock induces an endogenous fall in oil prices and interest rates. In this context, a geopolitical risk shock operates as a demand shock. When this negative effect on energy prices occurs – which is not the case for all countries – we have neutralized this endogenous effect, which does not seem to be operational in the current context, particularly in Europe, in order to make more robust quantitative assessments.

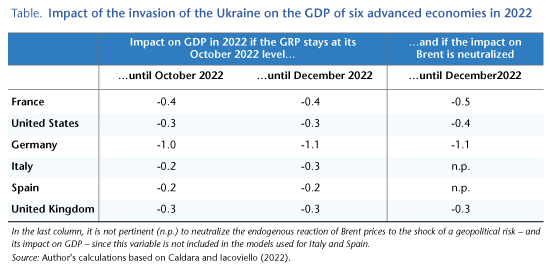

According to our estimates, if the global geopolitical risk index remains at its October 2022 level until the end of the year, the rise in geopolitical tensions observed in 2022 will have accounted for a 0.7 point drop in world merchandise trade (in volume terms) and a 0.6 point drop in world industrial production. In addition, Germany will have lost up to 1.1 percentage points of GDP in 2022 due to the year’s rising geopolitical tensions. Elsewhere, the effects are smaller but significant: between 0.4 and 0.5 points of GDP in France, and 0.3 and 0.4 points in the US, Italy and the UK. Finally, Spain’s GDP loss would be about 0.2 points (Table 1)[5].

These results provide a basis for reflection but should be taken with caution. Each international crisis is unique, and it is difficult to assess one exclusively in terms of a quantitative indicator. In particular, the current crisis has major consequences for Europe’s energy supply, especially in terms of gas, which produces a different crisis from what would spontaneously emerge from a statistical model based on observations in the past[6].

[1] Caution: When it is said that Russia’s invasion of Ukraine dates from 24 February 2022, this is done for ease of language. It should not be forgotten that parts of Ukraine’s territory, including the Crimea, have been under Russian control since 2014. What we are currently experiencing, far from being the beginning of a conflict, is above all the crossing of a milestone in a conflict that has persisted for many years.

[2] See Dauvin (2022) for an analysis of the impact of a supply shock on GDP growth in the six advanced economies.

[3] The reader interested in a more comprehensive presentation can refer to the original article for greater detail.

[4] The estimates are made using the local projection method of Jordà. See Òscar Jordà, 2005, “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review, vol. 95, no. 1, pp. 161-82. https://doi.org/10.1257/0002828053828518.

[5] Obviously, while most of the increase in international tension can be attributed to the consequences of Russian decisions, it is not possible to exclude other sources of international tension, particularly in connection with the future of Taiwan and Sino-American relations.

[6] Geerolf (2022) discusses the implications of modelling an energy supply shock specifically in the context of a Russian cut-off of the gas supply.