By Eric Heyer

In September 2007, the OFCE conducted simulations of the macroeconomic consequences of instituting a social value-added tax (VAT) using its emod.fr macroeconomic model. These simulations were discussed and published as an appendix to the Besson report on the subject. Nearly five years later, the government has decided to introduce a social VAT, so we asked Mathieu Plane and Xavier Timbeau to perform another round of simulations using the same model. The initial results were presented and discussed at a one-day workshop on the topic of taxation that took place at the Sciences-Politique Institute in Paris on 15 February. Why did we conduct new simulations, and how do they compare?

1. The measures simulated are different

There are a number of differences between the measure simulated in 2007 and the 2012 measure:

a. The shocks are on a different scale

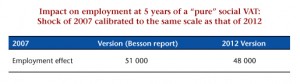

In 2007, the measure simulated involved a rise of 3.4 points in the nominal VAT rate, which was offset by an ex ante reduction in employer contributions of the same amount. The measure proposed by the government in 2012 represents a 1.6 point increase in the standard VAT, which corresponds to a 1.1 point increase in the effective rate (10.6 billion euros) and an increase in the CSG tax on capital income from 8.2% to 10.2%, which amounts to 2.6 billion. The additional 13.2 billion euros in revenue will fund the elimination of employers’ “family” social security contributions. Comparing the results requires at a minimum calibrating the shocks so that they are on the same scale. As our model is linear, a simple rule of three can then reassess the impact of the measure in 2007 and compare it with that of 2012. As is shown in the Table summarizing the results of this recalibration, the impacts on employment of the two versions are very similar.

b. The shocks are not the same type

Unlike the simulations in 2007, besides the fact that there is a dose of CSG in its funding, the reduction in the cuts in contributions proposed by the government in 2012 is not uniform. It is targeted in particular at companies with employees who are paid at 1.5 to 2.1 times the minimum wage (SMIC), which has different sectoral impacts depending on the wage structure and on the impact on the relative cost of unskilled / skilled labour. The fact that it is focused on skilled workers whose labour cost is less elastic reduces the expected impact on employment of lowering labour costs. This effect will also be reduced by the potential substitution of unskilled labor by skilled more productive labour. While this kind of effect is well documented in the literature, our econometric macro model does not yet enable us to take this into account. Our model is in the process of being enhanced, which will at some point make it possible to refine our results.

2. The model used (emod.fr) evolves in the course of re-estimations

Finally, it is necessary to keep in mind that macroeconomic models incorporate a certain number of estimated parameters, which can influence the results. This is the case in the simulation we are interested in of the elasticities of exports and imports to their prices and the elasticity of the substitution between capital and labor. However, the estimated value of these parameters is updated regularly to keep as close as possible to reality as captured by the national accounts. Thus, for example, the price elasticity of exports has changed considerably in recent years, from 0.57 to 0.31 between the version of the model used in 2007 and the 2012 model, meaning that any decline in price was less creative of activity and therefore of jobs.

In the next issue of the Revue de l’OFCE we will present all the results of our simulations in detail. We will also indicate the impact of a change in the value of the key elasticities on our assessments so that readers can better understand our revisions of the impacts.