It has been five years since commercial banks, in particular those in the euro zone, have faced a new challenge, that of continuing to generate profit in an environment marked by negative interest rates.

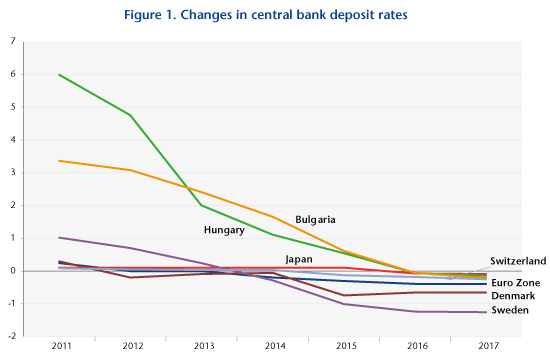

At the onset of the 2007-2008 global financial crisis, several central banks implemented new “unconventional” monetary policies. These consisted mainly of massive asset purchase programmes (commonly known as Quantitative Easing, QE) and forward guidance on interest rates. They aimed to lift the economies out of crisis by promoting better economic growth while avoiding a low level of inflation (or even deflation). Since 2012, six central banks in Europe (Bulgaria, Denmark, Hungary, Sweden, Switzerland and the European Central Bank) and the Bank of Japan have gradually introduced negative interest rates on bank deposits and reserves, in addition to the unconventional measures already in force. For example, the ECB’s deposit facility rate now stands at -0.40% (see Figure 1). Indeed, as indicated by Benoît Cœuré [1], the implementation of negative rates aim to tax banks’ excess reserves to encourage them to use these to boost the credit supply.

However, the implementation of negative rates has raised at least two concerns about the potential effects on bank profitability and risk-taking. First, the introduction of negative rates could hinder the transmission of monetary policy if this reduces banks’ interest margins and thus bank profitability. In addition, the lowering of credit rates for new loans and the revaluation of outstanding loans (mainly at variable rates) reduces banks’ net interest margin when the deposit rate cannot fall below the Zero Lower Bound. Second, in response to the impact on margins, the banks could either reduce the share of nonperforming loans on their balance sheets or look for other assets that are more profitable than loans (“Search-for-yield”). In a recent article [2], we used panel data from 2442 banks from the 28 member countries of the European Union over the period 2011-2017 to analyse the effects of negative rates on bank behaviour with respect to profitability and risk-taking. Specifically, we asked ourselves three questions: (1) What is the impact of negative rates on banks’ profitability? (2) Would negative rates encourage banks to take more risks? (3) Would the pressure on net interest margins from negative rates encourage banks to take more risk?

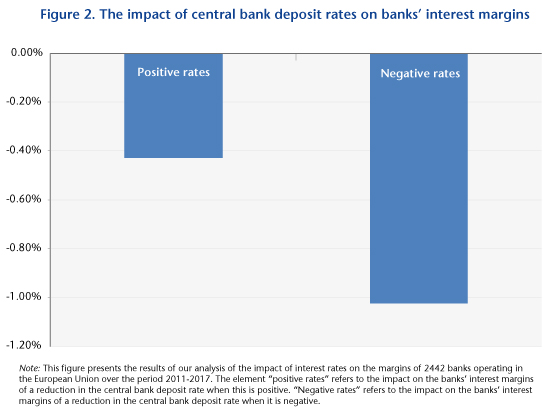

At the conclusion of our analysis, we highlight the presence of a threshold effect when interest rates fall below the zero bar. As can be seen in Figure 2, a 1% reduction in the central bank deposit rate reduced banks’ net interest margins by 0.429% when rates are positive, and by 1.023% when they are negative. Thus, negative rates have a greater impact on banks’ net interest margins than do positive rates. This result points to the presence of a threshold effect at zero. In addition, in response to this negative effect on margins (and in order to offset losses), the banks responded by expanding their non-interest rate activities (account management fees, commissions, etc.). As a result, in the short and medium term there was no indication that the banks resorted to riskier positions. However, the issue of risk-taking may eventually arise if negative rates persist for a long time and the banks continue to suffer losses on net interest margins.

[1] Coeuré B. (2016). Assessing the implication of negative interest rates. Speech at the Yale Financial Crisis Forum in New Haven. July 28, 2016.

[2] Boungou W. (2019). Negative Interest Rates, Bank Profitability and Risk-taking. Sciences Po OFCE Working Paper no. 10/2019.

Interesting findings! Here’s a quick summary from a consumer’s perspective: https://konvi.app/magazine/article/good-for-the-wallet-the-birth-of-negative-interest-rates/