Jérôme Creel, Xavier Ragot, and Francesco Saraceno

The second meeting of the Eurogroup did the trick. The Ministers of Finance, after having once again laid out their divisions on the issue of solidarity between euro area Member States on Tuesday 7 April 2020, reached an agreement two days later on a fiscal support plan that can be put in place fairly quickly. The health measures taken by the Member States to limit the spread of the Covid-19 pandemic will enjoy better short-term financing, which is good news. The additions to Europe’s tools for dealing with the crisis will be on the order of 500 billion euros – this is certainly not negligible, and note that this comes on top of the efforts already put in place by governments – but this corresponds mainly to a new accumulation of debt by the Member States. The net gain for each of them, as we shall see, is actually quite marginal.

The Eurogroup will propose the creation of a credit line (Pandemic Crisis Support) specifically dedicated to the management of the Covid-19 crisis within the framework of the European Stability Mechanism (ESM), without strict conditionality (meaning that recourse to the credit line will not imply any control on the part of the EMS over the future management of the Member State’s public finances). The creation of the credit line was inspired by the proposal by Bénassy-Quéré et al. (2020), the advantages and disadvantages of which we presented to the Eurogroup meeting on 9 April 2020. The amount allocated to this credit line represents around 2% of the GDP of each euro area Member State, or nearly 240 billion euros (in 2019 GDP).

The lending mechanism proposed by the European Commission to supplement the partial unemployment programmes of the Member States – it goes under the name of SURE – will clearly see the light of day and will be endowed with 100 billion euros. For the record, the three main beneficiaries of SURE cannot receive a combined total of more than 60 billion euros in loans.

Finally, the European Investment Bank (EIB) will grant an additional 200 billion euros, mainly to small and medium-sized enterprises in the EU Member States. In total, the euro area countries will have 480 billion euros in additional financing capacity.

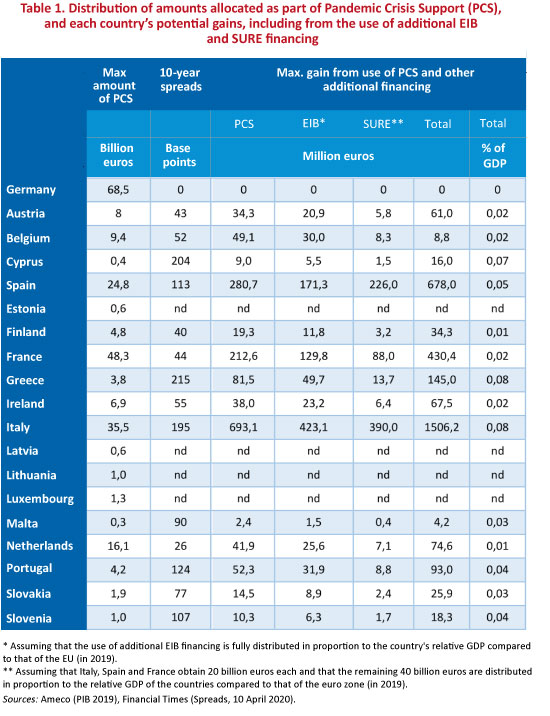

Table 1 below presents a breakdown by country of the amounts in play. As part of the 240 billion euros of Pandemic Crisis Support, Germany will be able to benefit from a borrowing capacity of nearly 70 billion euros, France nearly 50 billion euros, and Italy and Spain 35 and 25 billion euros respectively. These amounts correspond to 2% of the 2019 GDP of each country. At this point, there is no indication of whether the Member States will draw on this capacity. The advantage in doing so depends crucially on the difference between the interest rate at which they can finance their health and economic expenses without using the EMS and the interest rate on loans made by the EMS. The financing cost without going through the EMS is the interest rate on the country’s public debt. The cost of financing through Pandemic Crisis Support is the interest rate at which this credit line is itself financed, that is to say, at the lowest rate on the market, i.e. the German rate. So it is obvious that Germany has no interest in using this credit line. Of the 240 billion euros allocated to Pandemic Crisis Support, the 70 billion euros for Germany is thus useless. For countries other than Germany, the use of Pandemic Crisis Support depends on the difference between their interest rate and Germany’s rate, the infamous spread. If the spread is positive, using the EMS effectively reduces the cost of borrowing. But as shown in Table 1, the gain enabled by Pandemic Crisis Support is rather low. For Greece, whose spread vis-à-vis Germany is the highest in the euro zone, the gain would come to around 0.04% of GDP in 2019, i.e. a 215 basis point spread multiplied by the amount allocated to Greece for Pandemic Crisis Support (3.8 billion euros, which corresponds to 2% of its GDP of 2019), all relative to its 2019 GDP. For Italy, the gain is on the same order: 0.04% of its GDP. Expressed in euros, Italy stands to gain 700 million euros. For France, whose spread vis-à-vis Germany is much lower than that of Italy, the gain could be 200 million euros, or 0.01% of its GDP in 2019.

Assuming that the amounts allocated by the EIB are prorated to the country’s size (measured by its GDP in 2019), and that Spain, Italy and France benefit from 20 billion euros each under SURE, the total interest rate savings would reach, respectively, 680 million, 1.5 billion and 430 million euros (0.05%, 0.08% and 0.02% of GDP). At a time when it seems to be raining billions, these are not big savings. Unless you think of it as a metaphor. Like rain before it falls, the billions of euros are not really euros before they fall.

Leave a Reply