by A. Benramdane, S. Guillou, D. Harrich, and K. Yilmaz

Economies have been dramatically affected by the pandemic of Covid-19 in 2020 (OFCE, 2020). In response, several emergency measures have been undertaken by governments to support the people and the firms that were directly and strongly hit by the lockdowns. After the first shock in spring 2020, which had an international dimension, all economies experienced a decline in their production which jeopardizes their future and the wellbeing of their population. In the near future, bankruptcies and unemployment are expected to increase and the slowdown of private investment will minor both quantitatively and qualitatively the future capacities of production. Meanwhile, the huge rise in public debt will complicate the States’ ability to invest and promote long term growth through public investment. To cope with this dismal future, in addition to emergency measures, many governments have implemented recovery plans to boost and support the economy and to sustain a return to previous levels of wealth. Some governments try, through the recovery measures, to orient their future growth toward specific objectives. In the EU, the Resilience Recovery Facility (RRF), which aims to finance part of EU members’ plan, is adopting this stance by demanding that part of member’s plan will include at least 20% of measures dedicated to digital improvement and 27% dedicated to green investment.

This post is focused on the technological dimension of recovery plans designed to face the downturn triggered by the Covid-19. By technological, we mean what is related to R&D, innovation and digital technology. Our concern is associated with the fact that R&D investment as well as technological enhancements are fundamental seeds of future growth. They are necessary to ensure sustained growth under the paradigm of globalized competition where education, technology, and intellectual property are the materials of future comparative advantages (Haskel and Westlake, 2017).

Our interest in the technological dimension of EU recovery plans is also bound to the duality of the COVID-19 shock regarding technology. Indeed the COVID-19 entailed both a negative and a positive digital shock.

Negative because the economic crisis will lead firms to cut into their R&D spending which will affect negatively the nature and the amount of capital. There is indeed a risk that the smallest investors will cut into their R&D expenditure as well as their digital investment because of the lack of cash and the rise in debt. But meanwhile, the lockdowns fostered the use and adoption of digital tools to work, to organize, to produce and to sell. There are some digital firms which are benefiting a lot from the constraints imposed to the economy by the sanitary measures. The huge rise in share price of firms from tech and e-commerce sectors relative to more traditional sectors witnessed the division which is fracking economies. Given the leadership of those firms in world R&D investment, the latter are likely to be sustained by them, but traditional industries such as car, airplanes and smaller actors are likely to disinvest by lack of cash and rise in uncertainty. Moreover, letting the biggest ICT, digital and platform firms to drive the R&D will accentuate their leadership and expansion and be detrimental to competition.

Crises always divide unevenly the population of firms between winners/leaders and the losers/followers by giving larger market shares to the leaders which usually enter crises with larger financial means and other organizational buffers. But the nature of this crisis exacerbates the effect and highlights the frontier between digital users and producers and the rest of the firms. The only way to balance the superpower of digital giants is to reinforce the digital dimension of the rest of the economy. In addition, numerous studies established the existence of a digital dividend which means that increasing the digital intensity of the economy is helping to push growth (see for instance, Sorbe et al., 2019).

The direct political benefit of a digital orientation is weak, and the returns of investment in technology are not immediate and will not push growth in the short term. Hence, although governments might not be enticed with such orientation of their plans, they are expected to tackle the future needs for mastering digital technology. Recovery plans should account for the need for future growth to self-sustain and it explains the position of the EU.

This post aims to explain and evaluate the technological dimension of main members’ recovery plans within the EU framework of the RRF.

It shows that the 20% share recommended by the EU is not fully respected by Members’ plan. Germany is clearly the country which is allocating a higher weight to technology than other countries. Italy, while lagging behind in matter of R&D, productivity and digital indicators, is privileging emergencies expenses and France is mixing the two, pushing green technology.

The EU stance in favor of digital

In July 2020, the EU Council has agreed to create a €807 (or €750 in 2018 euros) billion Covid-19 recovery fund titled “Next Generation EU” in addition to the long-term budget of €1 211 billion.

The EU plan is mostly a framework with an amount of money to finance EU members’ plan after request. It is less of a Keynesian stimulus style than of a long-term structural reform plan. The final form of the EU plan was the result of the debates around the respective share of loans and subsidies and about the conditionalities to associate with the financing. Conditionality was hugely debated within the EU council.

The 2 pillars of the EU plan are digital and green orientations which should drive the investment projected by countries’ plan.

The digital pillar is associated with the long promotion of R&D and innovation throughout EU policies, goal which was clearly established in the Lisbon Agenda of 2000. The latter had the ambition to make the EU, by 2010, « the most competitive and dynamic knowledge-based economy in the world ». This ambition was associated with the objective of R&D spending reaching a 3% share of GDP. While the weight put specifically on the digital enhancement is new, it is inspired by the EU’s long-held belief in the power of technology to increase potential growth.

Regarding R&D the objectives have been matched only by Germany; Italy and France did not. The ratio of R&D spending to GDP reached a mere 1.43% for Italy in 2018. France performed slightly better than Italy by keeping this ratio at 2.19% percent in 2018, still below the target of 3%. Despite the failure to reach the Lisbon’s goals, the EU has always fostered R&D policies with a generous financing budget and a very flexible monitoring of State aids dedicated to encouraging research and innovation.

For the last 10 years, China joined the United States as a source of challenging competitors to EU companies. The EU is increasingly lagging behind concerning digital activities from e-commerce, e-finance to cloud services. The need for digitalization to help the economy and the SMEs cope with the new digital turn of branches of the economy is motivating the EU digital policy. Regarding digital indicators (OECD digital indicators), Italy is lagging behind in ICT adoption, e-commerce or R&D intensity while France and Germany are very close to each other.

Green objectives came later in the EU policies but are more and more central and invade all areas up to R&D for which an increasing part has to be dedicated to the fight against climate change. The new EU commission (from May 2020 elections) presided by Ursula Von der Leyen has launched a green new deal and planned to achieve carbon neutrality by 2050.

The next multiannual long-term budget for 2021-2027 is divided into 2 parts: the long-term budget (or the multiannual financial framework) of €1 211 billion and the NGEU (Next Generation EU) of €807 billion (in current euros). The Resilience Recovery Fund is part of the EU budget for the next 6 years. The RRF is taken from the NGEU and amounts to €724 billion.[1]

To benefit from the RRF, EU countries have to present a recovery plan with respect to the economic recommendations made by the EU Commission in the last semester.

Besides the RRF, the multiannual budget is distributed into 7 headings. In the previous multiannual budget, the Competitiveness heading (now named “Single market, Innovation and Digital, SID”) – which includes the R&D funding Horizon 2020 – had 20% of the budget. In the next multiannual budget, the share of the whole budget dedicated to the heading SID — which includes innovation and R&D — has increased. As of the end of 2020, the budget for SID is €143.4 billion (MMF plus €5 billion from NGEU) of which Horizon Europe is €84.9 billion and Digital Europe Program is 6.761 billion.

On the green side, the budget is not under a single heading. Members committed themselves to spend 30% of the next budget to the fight against climate change. To match the 30%, financings are affected to the green objective weighted conditionally on their objective. A weight of 1 is affected to measures 100% dedicated to climate concerns.

Technological orientations of main EU members’ plan

Germany has been of great influence in the greening of EU policies. Angela Merkel, dubbed the « climate chancellor », definitely gave a green direction to the German economy, abandoning nuclear energy and investing a lot in green energies.

Meanwhile, the government was more recently concerned by technological challenges and Chinese competition which may threaten its leadership in manufacturing. Germany’s Post-Covid Recovery Plan was set under the umbrella of the country’s High-Tech Strategy 2025 (HTS 2025) which was decided in September 2018. The latter was aiming to increase the share of R&D spending to 3.5% of its GDP. The implementation of a research and development tax credit, imitating the French one, was an additional step in its alignment on other countries R&D support (see Guillou and Salies, 2020). In 2018, 3.13% of GDP, or €105 billion, was spent on R&D. COVID crisis aside, Germany has already committed to the ambitious goal of raising R&D Investment as a share of GDP to 3.5%, which will be an estimated €168 billion by 2025.[2]

The way Germany is hoping to achieve this goal is by revamping and overhauling its incentives on investment. Given that 70% of German R&D comes from private investments, the German state is trying to create a framework that provides private enterprises and individuals the freedom to innovate[3]. For example, the recently created Agency to Promote Break-Through Innovation will provide insurance to scientists and businesses who undertake cutting-edge disruptive innovation. Given the inherent risk to R&D, this insurance is meant to guarantee that individuals worry less about the risk and focus more on achieving breakthrough results[4]. Similarly, SMEs typically do not undertake R&D given the expenses associated and the difficulty in capturing the returns on investments. This is why the German government launched its Transfer Initiative Program, that will help SMEs turn the fruits of their research into tangible marketable products, while also providing businesses with less than 100 employees grants that cover up to 50% of their incurred R&D costs.[5]

France has dedicated large sums to support its firms’ R&D with the most generous support among OECD countries. France praises itself with maintaining a high level of public investment in R&D, notably when it comes to the energy sector. In 2019, spending dedicated to the energy sector (€1163M) progressed by 5% compared to 2018, mostly focusing on nuclear energy (€732M) and renewables (€324M). The share dedicated to fossil energy has now fallen to represent only 1% of total R&D financing. Among G7 countries, only Japan spends more as a percentage of GDP when it comes to public spending dedicated to R&D in the energy sector.

R&D spending in the green sector in France is also a priority of the France Relance recovery plan. Out of the €30 billion dedicated to ecology, approximately 6.5 billion euros are planned to be dedicated to R&D in green technologies and the decarbonation of multiple industries (see details in the attached table). The Fiscal Monitor of the IMF released in October showed that France was the country within G20 with the highest share relative to GDP of its plan dedicate to climate issues (IMF, 2020, page 24).

While ecology is a major concern of the recovery plan, the energy transition towards renewable energy has been a goal since the Paris Accord. In 2019, the Parliament had adopted the law “Loi Energie-Climat” to aim at achieving carbon neutrality by 2050, in line with the European Union. Yet, the Commission for Economic Affairs announced on November 12, 2020 that the budget for 2021, including the recovery plan France Relance, will be insufficient to achieve this goal.

In Italy the recovery plan was decided in a tough political context and very narrow budgetary marge de manœuvre. The Italian Prime Minister Giuseppe Conte seized the EU funding as “an opportunity to build a better Italy” by promising the nation that no single cent will go in waste. This promise comes in the wake of a lingering economical recession as Italy was one of the most affected EU countries by the Great Recession of 2008 and the Sovereign Debt Crisis of 2011.

In a calculated move to add more seats to his coalition, the Prime Minister Conte has resigned on 26 January upon disputes with the opposition on the use of the EU funds to fight against the coronavirus crisis. His promise of “building a better Italy” in June 2020 is at stake upon this new decision that caused yet another political instability in the country.

Since 1995, the country maintained its government debt to GDP ratio over 100%, contrary to the 60% level set by the Maastricht criteria. Moreover, the country was strikingly hit by the Great Recession. Italy’s GDP shrunk by 5.28% in 2009, and in fact the average annual real growth per capita between 1999-2016 was 0 percent. Moreover, unemployment soared to 1970-80 levels of 12.7% in 2014. Overall, these crises have aggravated the social, territorial, and gender inequalities, and also resulted in an outflow of skilled young workforce. Many of these weaknesses are tied to technological and educational gaps. For instance, Italy’s R&D spending in 2017 stayed at 1.33% of the GDP compared to the EU average of 1.96 %, 2.22% for France and 2.93% for Germany (source OCDE). Italy’s annual GDP growth of 0.343% in 2019 has also underperformed below the EU average of 1.554% in the same year. Antonin et al. (2019) underlined that Italy was trapped into a repetitive slowdown for structural reasons such as the North-South dualism, the small size of companies and a large share in low-tech sectors, which all affect negatively its productivity growth.

Digital dimension of Recovery plans

Most countries implemented measures to face the economic urgencies. Then, given how strong their economies were affected, they had to implement recovery measures and submit plans to the EU in order to benefit from the RRF subsidies and loans.

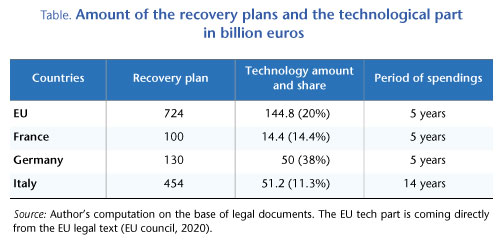

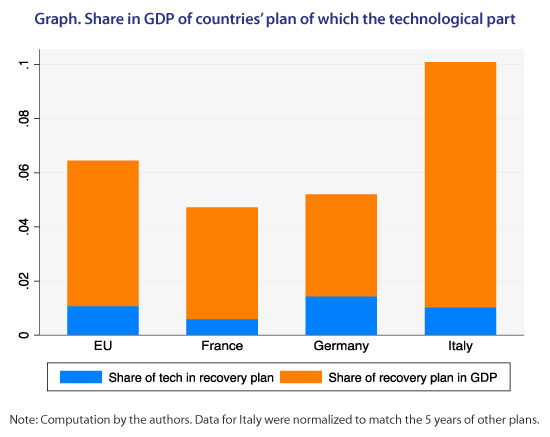

In Table 1, we list the amount of the total recovery plan per country and the part that is dedicated to « technology, innovation and R&D » investment (Tech. part). We list the « tech » characteristics of this part which may differ by country and last, we give the period during which the amount is expected to be spent. Green investment could also include R&D investment. We tried to retrieve the R&D content of policies which primary aim is not R&D.

Germany passed its Konjunkturpaket (known commonly as the « Wumms » Recovery Plan) on the night between June 3rd and June 4th.[6] The €130 billion project (or 3.8% of German GDP) covers three main sectors of the economy, and by and large is centered around the consumer.[7] Many elements of the Wumms plan are dedicated to increasing consumer confidence, boosting consumption, and raising aggregate demand. As such:

- €32.5 billion are going to directly benefits consumers and households in two main ways. Firstly, households will benefit from a child bonus (EUR300 per child), totaling an estimated €5 billion. In addition, all German consumers will benefit from the €27.5 billion VAT cut that will lower VAT rates from 19% to 16%.[8] This measure will come into effect in the second half of 2020;

- €25 billion is earmarked for the worst impacted sectors — hotels, restaurants, bars, and clubs — that were forced to close from June to August. Moreover, these corporations are set to benefit from corporate tax relief valued at €13 billion;

- Finally, €50 billion is being spent on preparing Germany for the future, particularly taking the shape of incentives to increase R&D investments in cutting edge green components. Once again, the consumer is central as the plan includes grants to increase the affordability of Electrical Vehicles to the average German. The Deutsche Bahn will be given €5 billion in equity to allow for the modernization and electrification of its rail network, while the fleet of buses in Germany’s public transportation grid will be upgraded to more sustainable models. Municipalities and public institutions are being given €10 billion to help fast-track the modernization of public transport infrastructure.[9]

The German government has specified a share of €50 billion towards R&D and Green transition efforts in their Wumms package. While the R&D-share of total recovery is high, it must be remembered that Germany already has a complementary R&D Strategy (High-Tech Strategy 2025) previously presented.

Called “France Relance”, the French plan ambitions to revert back in 2022 to levels of growth and economic activity similar to those achieved prior to the crisis. It was initially announced by President Emmanuel Macron on July 14th, and later officially presented on September 3rd by prime minister Jean Castex. It is part of the total state budget, exposed in the “Projet Loi de Finance 2021” and amounts to 100 billion euros spread over 5 years, until 2025. The plan has three main targets, and the 100 billion euros are distributed accordingly:

- €30 billion for the environmental transition

- €35 billion for competitiveness and innovation

- €36 billion for social cohesion

The first and second items have R&D targets and the second has a specific objective of digitalization.

The digital share is coming from the sum of R&D-oriented & green measures included in all three parts of Plan France Relance, which is also included in the Program for Investments of the Future (Programme d’Investissements d’Avenir, PIA). Indeed, in parallel to the French “plan de relance”, France has announced a fourth Program for Investments of the Future (PIA) that will serve to finance a major part of the digital and green innovation and research components of the plan France Relance.

Out of the 20 billion euros of the PIA, 11 billion euros are specifically dedicated to the France Relance plan over five years. This amount is divided into four categories of spending:

- Green technology and innovation: 3.4 billion euros dedicated to the development of green technologies and sectors, specifically when it comes to green hydrogen, recycling, biotechnologies, green transition of industries, and improving the resilience of cities to climate and health risks.

- Economic resilience and sovereignty: 2.6 billion euros dedicated to support the development of key digital industries (cybersecurity, cloud, digital health system, bioproduction of innovative therapies…)

- Support ecosystems of research, innovation, and higher education: 2.55 Billion euros

- Supporting businesses engaged in innovative industries: 1.95 billion euros dedicated to finance and cover the financial risks inherent to their R&D plans in order to support further bold innovative projects.

In addition to the PIA, complementary measures include: decarbonation of key industries (aeronautic, automobile, railway…) (1.2 bn); the development of green hydrogen (2 bn); preserving jobs in the R&D sectors (0.3 bn); Strengthening the resources of the National Research Agency (ANR) (0.4 bn). The sum amounts to €14.4 billion. These ambitious goals have to tackle companies’ own trajectories which may be in contradiction in the short run, such as the recent decision of Sanofi to eliminate 364 positions

Italy has presented the National Recovery and Resilience Plan (Piano nazionale di resilienza e rilancio) on 15 September to commit to the condition from the EU to submit a draft proposal for the use of COVID-19 funds. The final draft is to be decided by January 2021.

Three strategic lines for recovery:

- Modernization of the country: efficient, digitized, and with less red-tape public administration that truly serves the people, creating an environment suitable for innovation, promote research, and increase productivity and quality of life;

- Ecological transition: decreasing greenhouse gas emissions in accordance with the EU Green Deal, increase the energy efficiency of production chains and transition to produce environmentally friendly materials, reforestation, and investment in sustainable agriculture;

- Social and territorial inclusion, equality of gender: reducing inequalities, poverty, and gaps in access to education and public services especially in the South, strengthening the health system, improving the inclusion of women in all areas of workforce and administration.

The amount and specific measures are not yet been displayed with details. Regarding Italy, of the €51.2 billion that the government has allocated for digital investments, €2.5 bn are allocated for “Digital & Green Skills.” However, the Italian plan has a separate “green” segment where 62.4 billion euros are allocated.

Conclusion

The R&D has long been a priority in the agenda of the EU, and the only industrial policy that was unlimited. Obstacles in achieving the Lisbon Agenda, dated from 2000, have been diluted into institutional and economic problems but R&D and technology have relentlessly been flagship policies put forward by the EU commission. More recently the green objectives and the carbon neutrality have gained momentum and R&D financing is more and more in association with environmental innovation. This is for instance the case in the battery project. Nevertheless, the technological dimension of EU policies is oriented toward the digital dividend in accordance with the new commissioner Thierry Breton in charge of the “Single Market, Innovation and Digital” heading. Coherently the EU is pushing members to invest in the digital dimension of their economy. But we observed that the members are not as ambitious as the EU would expect in this respect. Germany is one of the few members to commit to engage massive investment in digitalization, but it is in coherence with pre-COVID commitments the country took. The EU RRF orientations are yet insufficient to trigger digital convergence.

References :

Antonin C., M. Guerini, M. Napoletano, and F. Vona (2019), « Italie, sortir du double piège de l’endettement élevé et de la faible croissance », Policy Brief OFCE, No 55, 14 May. https://www.ofce.sciencespo.fr/pdf/pbrief/2019/OFCEpbrief55.pdfhttps:

European Commission (2020), Commission Staff Working Document, Guidance to Member States Recovery and Resilience Plans: https://ec.europa.eu/info/files/guidance-member-states-recovery-and-resilience-plans_en

European Council (2020), Final conclusions, July.

The Economist (2019), “Emmanuel Macron in His Own Words (English).” , The Economist Newspaper: https://www.economist.com/europe/2019/11/07/emmanuel-macron-in-his-own-words-english

Guillou, S. and E. Salies (2020), L’Allemagne prise dans l’engrenage du CIR, Juin, Blog OFCE.

“GDP Growth (Annual %) – European Union, Italy.” Data, data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=EU-IT&most_recent_year_desc=false.

Haskel and Westlake (2017), Capitalism without capital, Princeton University Press.

IMF (2020), Fiscal Monitor, Policies for the recovery, chapter 1, october.

“Italy GDP Annual Growth Rate1961-2020 Data: 2021-2023 Forecast: Calendar.” Italy GDP Annual Growth Rate | 1961-2020 Data | 2021-2023 Forecast | Calendar, tradingeconomics.com/italy/gdp-growth-annual.

Sorbe et al. (2019), “Digital dividend: Policies to harness the productivity potential of digital technologies”, OECD working paper.

Algebris Investments (2020) “The Italian National Recovery Plan: What Do We

Know?” Algebris Investments, 25 Sept. 2020, www.algebris.com/policy-research-forum/the-italian-national-recovery-plan-what-do-we-know/.

[1] In turn the RRF is divided into subsidies (52%) and loans (48%). The RRF billions are to be spent between 2020 and 2023. Seventy percent of the RRF subsidies will be allowed to EU members before 2022 with respect to 2019 population, gross domestic income per head and unemployment rate. The thirty percent left will be allocated to EU members in 2023 conditional on the crisis impact on the member’s economy.

[2] https://www.bmwi.de/Redaktion/EN/Publikationen/Wirtschaft/2019-annual-economic-report.pdf?__blob=publicationFile&v=6

[3] https://www.bmwi.de/Redaktion/EN/Publikationen/staerkung-von-investitionen-in-deutschland-en.pdf?__blob=publicationFile&v=1

[4] https://www.bundesbericht-forschung-innovation.de/files/BMBF_BuFI-2020_Hauptband.pdf

[5] https://www.bundesbericht-forschung-innovation.de/files/BMBF_BuFI-2020_Hauptband.pdf

[6] See DAP, Perspectives économiques 2020-2021 d’octobre 2020, Part I.2, Revue de l’OFCE, 168, 2020.

[7]https://www.allianz.com/en/economic_research/publications/specials_fmo/2020_09_18_durationrisk1.html

[8] https://de.reuters.com/article/healthcoronavirus-germany-stimulus-idUKL8N2DG3XU

[9] https://www.lemoci.com/wp-content/uploads/2020/09/20200917_comparison-fr-de-stimulus_final.pdf

Poster un Commentaire