At the start of 2012, some Socialist Party leaders have renewed the claim that the “family quotient” tax-splitting system is unfair because it does not benefit poor families who do not pay taxes, and benefits rich families more than it does poor families. This reveals some misunderstanding about how the tax and social welfare system works.

Can we replace the family quotient by a flat benefit of 607 euros per child, as suggested by some Socialist leaders, drawing on the work of the Treasury? The only justification for this level of 607 euros is an accounting device, i.e. the total current cost of the family quotient uniformly distributed per child. But this cost stems precisely from the existence of the quotient. A tax credit with no guarantee of indexation would see a quick fall in its relative purchasing power, just like the family allowance (allocation familiale – AF).

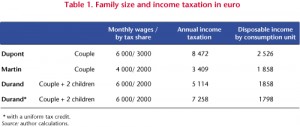

With a credit like this, taking children into account for taxation purposes would lose all sense. As shown in Table 1, families with children would be overtaxed relative to childless couples with the same income (per consumption unit before tax), and their after-tax income would be lower. The Constitutional Council would undoubtedly censor such a provision.

France is the only country to practice a family quotient system. Each family is assigned a number of tax parts or shares, P, based on its composition; the shares correspond roughly to the family’s number of consumption units (CU), as these are defined by the OECD and INSEE; the tax system assumes that each family member has a standard of living equivalent to that of a single earner with revenue R/P; the family is then taxed like P single earners with income R/P.

The degree of redistribution assured by the tax system is determined by the tax schedule, which defines the progressivity of the tax system; it is the same for all categories of households.

The family quotient (QF) is thus a logical and necessary component of a progressive tax system. It does not provide any specific support or benefit to families; it merely guarantees a fair distribution of the tax burden among families of different sizes but with an equivalent standard of living. The QF does not constitute an arbitrary support to families, which would increase with income, and which would obviously be unjustifiable.

Let’s take an example. The Durand family has two children, and pays 3358 euros less than the Dupont family in income tax (Table 1). Is this a tax benefit of 3358 euros? No, because the Durands are less well off than the Duponts; they have 2000 euros per tax share instead of 3000. On the other hand, the Durands pay as much per share in income tax as the Martins, who have the same standard of living. The Durands therefore do not benefit from any tax advantage.

The family quotient takes into account household size; while doing this is certainly open for debate, one cannot treat a tax system that does not take into account household size as the norm and then conclude that any deviation from this norm constitutes a benefit. There is no reason to levy the same income tax on the childless Duponts and the two-child Durands, who, while they have the same level of pay, do not enjoy the same standard of living.

In addition, capping the family quotient [1] takes into account that the highest portion of income is not used for the consumption of the children.

Society can choose whether to grant social benefits, but it has no right to question the principle of the fairness of family-based taxation: each family should be taxed according to its standard of living. Undermining this principle would be unconstitutional, and contrary to the Declaration of the Rights of Man, which states that “the common taxation … should be apportioned equally among all citizens according to their capacity to pay”. The law guarantees the right of couples to marry, to build families, and to pool their resources. Income tax must be family-based and should assess the ability to pay of families with different compositions. Furthermore, should France’s Constitutional Council be trusted to put a halt to any challenge to the family quotient? [2]

The only criticism of the family quotient system that is socially and intellectually acceptable must therefore focus on its modalities, and not on the basic principle. Do the tax shares correspond well to consumption units (taking into account the need for simplicity)? Is the level of the cap on the family quotient appropriate? If the legislature feels that it is unable to compare the living standards of families of different sizes, then it should renounce a progressive system of taxation.

Family policy includes a great variety of instruments [3]. Means-tested benefits (RSA, the “complément familial”, housing benefit, ARS) are intended to ensure a satisfactory standard of living to the poorest families. For other families, universal benefits should partially offset the cost of the child. The tax system cannot offer more help to poor families than simply not taxing them. It must be fair to others. It is absurd to blame the family quotient for not benefitting the poorest families: they benefit fully from not being taxed, and means-tested benefits help those who are not taxable.

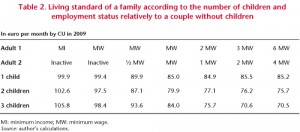

Table 2 shows the disposable income per consumption unit of a married employed couple according to the number of children, relative to the income per consumption unit of a childless couple. Using the OECD-INSEE CUs, it appears that for low-income levels families with children have roughly the same standard of living as couples without children. By contrast, beyond an earnings level of twice the minimum wage, families with children always have a standard of living much lower than that of childless couples. Shouldn’t we take into account that having three or more children often forces women to limit their work hours or even stop work? It is the middle classes who experience the greatest loss of purchasing power when raising children. Do we need a reform that would reduce their relative position still further?

The standard of living of the family falls as the number of children rises. Having children is thus never a tax shelter, even at high income levels. So if a reform of family policy is needed, it would involve increasing the level of child benefit for all, and not the questioning of the family quotient system.

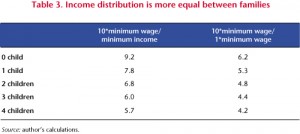

Overall, redistribution is greater for families than for couples without children: the ratio of disposable income between a couple who earns 10 times the minimum wage and a couple who earns the minimum wage is 6.2 if they have no children; 4.8 if they have two children; and 4.4 if they have three. The existence of the family quotient does not reduce the progressivity of the tax and social welfare system for large families (Table 3).

Consider a family with two children in which the man earns the minimum wage and the wife doesn’t work. Every month the family receives 174 euros in family benefits (AF + ARS), 309 euros for the RSA and 361 euros in housing benefit. Their disposable income is 1916 euros on a pre-tax income of 1107 euros; even taking into account VAT, their net tax rate is negative (-44%). Without children, the family would have only 83 euros for the PPE and 172 euros in housing benefit. Each child thus “brings in” 295 euros. Income is 912 euros per CU, compared with 885 euros per month if there were no children. Family policy thus bears the full cost of the children, and the parents suffer no loss of purchasing power due to the presence of the children.

Now consider a large wealthy family with two children where the man earns 6 times the minimum wage and the woman 4 times. Every month this family receives 126 euros in family benefits and pays 1732 euros in income tax. Their disposable income is 7396 euros on a pre-tax income of 10,851 euros; taking into account VAT, their tax rate is a positive 44%. The French system therefore obliges wealthy families to contribute, while financing poor families. Without children, the wealthy family would pay 389 euros more tax per month. Its income per CU is 4402 euros per month, compared with 5819 euros if there were no children. The parents suffer a 24.4% loss in their living standard due to the presence of the children.

Finally, note that this wealthy family receives 126 euros per month for the AF, benefits from a 389 euro reduction in income tax, and pays 737 euros per month in family contributions. Unlike the poor family, it would benefit from the complete elimination of the family policy.

It would certainly be desirable to increase the living standards of the poorest families: the poverty rate for children under age 18 remains high, at 17.7% in 2009, versus 13.5% for the population as a whole. But this effort should be financed by all taxpayers, and not specifically by families.

No political party is proposing strong measures for families: a major upgrade in family benefits, especially the “complément familial” or the “child” component of the RSA; the allocation of the “child” component of the RSA to the children of the unemployed; or the indexation of family benefits and the RSA on wages, and not on prices.

Worse, in 2011, the government, which now poses as a defender of family policy, decided not to index family benefits on inflation, with a consequent 1% loss of purchasing power, while the purchasing power of retirees was maintained. Children do not vote …

I find it difficult to believe that large families, and even families with two children, especially middle-class families with children, those where the parents (especially the mothers) juggle their schedules in order to look after their children while still working, are profiting unfairly from the current system. Is it really necessary to propose a reform that increases the tax burden on families, especially large families?

[1] The advantage provided by the family quotient is currently capped at 2585 euros per half a tax share. This level is justified. A child represents on average 0.35 CU (0.3 in the range 0 to 15 year old, and 0.5 above). This ceiling corresponds to a zero-rating of 35% of median income. See H. Sterdyniak: “Faut-il remettre en cause la politique familiale française?” [Should French family policy be called into question?], Revue de l’OFCE, no. 16, January 2011.

[2] As it has already intervened to require that the Prime pour l’emploi benefit takes into account family composition.

[3] See Sterdyniak (2011), op.cit.