For the first time since June 2021, inflation, as measured by the Harmonised Index of Consumer Prices (HICP), has fallen in the euro zone for two months in a row. However, it remains high, as prices rose by 9.2% year-on-year in December 2022 and by 8.4% for the year as a whole. This trend has been seen in the US since June 2022, with the year-on-year change in the consumer price index falling from 9% to 6.4% in December. On an annual average basis, however, inflation was 8%, 3.3 percentage points higher than in 2021. Indeed, although there may be significant differences between countries, particularly in the euro zone[1], rising prices are a global phenomenon, and inflation is at much higher levels than the average for many years now. What can be inferred from the declines observed in recent months? Has peak inflation been reached? The answer to these questions depends, among other things, on the specific factors that have contributed to inflation since 2021 and to its recent decline. This diagnosis not only is crucial for household living standards, but it also determines the monetary policy stance for 2023 of the European Central Bank (ECB) and the Federal Reserve, since both target 2% inflation.

Lower inflation linked to falling energy prices …

Since late summer 2020, inflation in all the industrialised countries has risen almost uninterruptedly to a level not seen since the early 1980s. This can be explained by supply and demand factors. In a context still marked by the situation of health in 2021 and 2022, production capacities remained constrained because of the various waves of the pandemic, which disrupted the functioning of the labour market and supply chains, in particular due to China’s zero-covid strategy. On the demand side, income support measures taken during lockdowns fuelled first savings and then household consumption expenditure, particularly in the US. The rebound in inflation was also driven by the rebound in energy prices, amplified by Russia’s invasion of Ukraine, which triggered an energy crisis. At the same time, climate factors pushed up food prices, which were in turn exacerbated by the conflict between two major grain producers[2].

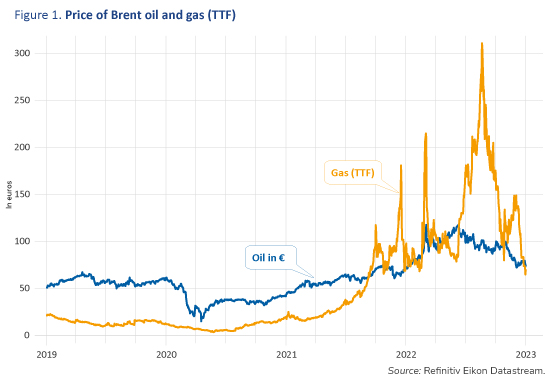

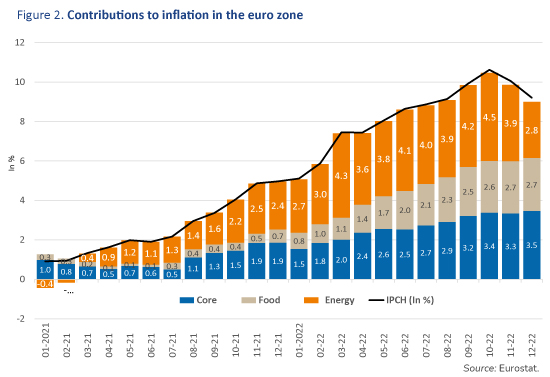

Indeed, as of October 2022, energy prices in the euro zone had risen by over 40% year on year, contributing 4.2 percentage points to inflation[3]. The rise in energy prices slowed in December to 25.7% year-on-year. The energy index largely reflects changes in the market prices for oil and gas. However, the surge observed for several months now seems to be reversing. After peaking at over USD 120 per barrel in mid-June 2022, the price of Brent crude has returned to the level seen before Russia invaded Ukraine. The price of gas has suffered an unprecedented shock, but it has also been trending downward recently (Figure 1). At the end of August 2022, it peaked at over 310 euros per megawatt hour, a level 15 times higher than observed in January 2021[4]. These declines in oil and gas prices thus explain the trends in inflation over the last two months. In the US, the decline occurred earlier, in line with oil prices and because the rise in US gas was much more moderate[5].

… but rising core inflation

However, once energy is excluded inflation is not falling. First, food prices in the euro zone are continuing to rise: 13.6% in December for the euro zone as a whole, partly reflecting the impact of past energy price rises on costs. And second, core inflation, adjusted for energy and food prices, is also high: 5.2% in December in the euro zone and 6% in the US. Moreover, it is continuing to rise, and is increasingly contributing to the overall rise: 3.5 points in the euro zone in December 2022 compared with 1.9 points a year earlier (Figure 2) [6]. This rise in core inflation suggests a gradual diffusion of inflation. The price of energy directly affects production costs, which in turn affects the prices of consumer goods and services excluding energy[7].

In addition to the energy shock, supply and demand factors may also have contributed to the resurgence of inflation. On the supply side, the blockage of global production chains – notably due to the local lockdowns imposed in China until recently, and the shipping bottlenecks that appeared at the end of 2020 with the resumption of international trade – caused price pressures that contributed to the rise in the prices of output and final goods. These factors appear to have played a dominant role in 2021 in both the US and the euro zone[8]. On the demand side, expansionary monetary and fiscal policies in 2020 and 2021 made for easier financing conditions and boosted the incomes of economic agents. These measures were intended to absorb shocks, but the way they were calibrated may also have contributed to inflation, particularly in the US. American researchers have estimated the contribution of the fiscal support plans (Coronavirus Aid, Relief, and Economic Security Act and American Rescue Plan) to nearly 3 points of inflation by the end of 2021, confirming fears that the American economy was overheating[9]. A more recent analysis assessing only the effect of the March 2021 Biden plan estimates its contribution to core inflation at nearly 50%[10]. In the euro zone, demand factors definitely played a less important role, in particular because household income support measures have been less extensive than in the US[11].

Will inflation continue to fall? Yes, most likely in connection with energy prices. In addition, the supply-and-demand factors that have been driving prices up should also dissipate. The indicator of constraints on production is not yet back to its long-term average, but it has fallen sharply. On the demand and fiscal policy side, the effects of the support policies put in place during the health crisis are fading. Since then, new measures have been implemented in the euro zone to cushion the cost of the energy crisis on households through subsidies and price freezes. However, consumers are expected to suffer losses in purchasing power, which will weigh on demand[12]. Will inflation return to 2%? Probably not in 2023. Food prices show no sign of easing, which will continue to put a strain on everyday household spending. Moreover, part of the inflationary shock has effectively spread to all prices, as shown by changes in core inflation[13]. Finally, the gradual lifting of tariff shields in 2023 and 2024 should slow down disinflation by spreading the effect of the energy shock on households over time. Under these conditions, central banks will undoubtedly continue to raise interest rates. However, they could slow down the pace of rate increases to a lower level than they would have envisaged if inflation had remained at a level close to 10%.

[1] According to the figures published by Eurostat for December, inflation is over 20% in Latvia and Lithuania, and over 10% in Italy, the Netherlands and Austria. Conversely, it is 5.6% in Spain and 6.7% in France. Blot, Creel, Geerolf and Levasseur (2022) analyse this heterogeneity of inflation rates in the euro zone and show that it is largely explained by energy prices and by rates that have been particularly high in some small euro zone economies, notably the Baltic countries.

[2] Also note that part of the rise in food prices is due to higher energy prices.

[3] In the US, this rise in the energy index peaked in June 2022, with a year-on-year price change of +41.5%, contributing 2.6 percentage points to inflation. This fell to 7% in December, contributing only 0.5 percentage points to total inflation.

[4] The war in Ukraine has strongly contributed to the surge in the price of European gas, but the price had already risen sharply before the outbreak of the war, reaching an average of 84 euros per Megawatt hour in January 2022.

[5] See “Gaz naturel : pourquoi ça flambe” [“Natural gas: Why is it on fire?” – in French] on the more regional dimension of the gas market.

[6] In the US, the contribution of core inflation in December 2022 returned to the same level as in December 2021 (4.6 and 4.5 points respectively) after peaking at 5.4 points in October 2022.

[7] Price rises could also push wages higher, reinforcing higher costs and prices through a second-round effect.

[8] See this analysis, which relies on an indicator of the pressure on supply chains.

[9] See Jordà, Liu, Necchio and Rivera-Reyes (2022).

[10] See Ball, Leigh and Mishra (2022).

[11] See Blot C. & M. Plane (2021), “Relance aux États-Unis et en Europe : Un océan les sépare” [Recovery in the US and Europe: An Ocean Apart – in French], L’Economie politique, no. 3, pp. 73-87.

[12] See our analysis from October 2022 on the impact of the energy shock on France and the main advanced economies.

[13] Alternative indicators of core inflation calculated for the US also confirm the diagnosis of price increases that exceed 6%. See here.