By Marion Cochard and Danielle Schweisguth

On 29 May, the European Commission sent the members of the European Union its new economic policy recommendations. As part of this, the Commission granted France an additional two years to reach the deficit reduction target of 3%. This target is now set for 2015, and to achieve this the European Commission is calling for fiscal impulses of -1.3 GDP points in 2013 and -0.8 point in 2014 (see “Austerity in Europe: a change of course?”). This would ease the structural effort needed, since the implementation of the previous commitments would have required impulses of -2.1 and -1.3 GDP points for 2013 and 2014, respectively.

Despite this, the French government has chosen not to relax its austerity policy and is keeping in place all the measures announced in the draft Finance Act (PLF) of autumn 2012. The continuing austerity measures go well beyond the Commission’s recommendations: a negative fiscal impulse of -1.8 GDP point, including a 1.4 percentage point increase in the tax burden for the year 2013 alone. Worse, the broad guidelines for the 2014 budget presented by the government to Parliament on 2 July 2013 point to a structural effort of 20 billion euros for 2014, i.e. one percentage point of GDP, whereas the Commission required only 0.8 point. The government is thus demanding an additional 0.6 GDP point fiscal cut, which it had already set out in the multi-year spending program in the 2013 Finance Act.

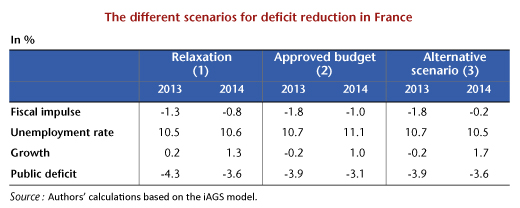

The table below helps to provide an overview of the effort and of its impact on the French economy. It shows the trends in growth, in unemployment and in the government deficit in 2013 and 2014, according to three budget strategies:

- One using the relaxation recommended by the Commission in May 2013;

- One based on the budget approved by the government for 2013 and, a priori, for 2014;

- One based on an alternative scenario that takes into account the negative 1.8 GDP point fiscal impulse for 2013 and calculates a fiscal impulse for 2014 that would be sufficient to meet the European Commission’s public deficit target of -3.6%.

According to our estimates using the iAGS model [1], the public deficit would be cut to 3.1% of GDP in 2014 in scenario (2), whereas the Commission requires only 3.6%. As a consequence of this excess of zeal, the cumulative growth for 2013 and 2014 if the approved budget is applied would be 0.7 percentage point lower than growth in the other two scenarios (0.8 point against 1.5 points). The corollary is an increase in unemployment in 2013 and 2014: the unemployment rate, around 9.9% in 2012, would thus rise to 11.1% in 2014, an increase of more than 350,000 unemployed for the period. In contrast, the more relaxed scenario from the European Commission would see a quasi-stabilization of unemployment in 2013, while the alternative scenario would make it possible to reverse the trend in unemployment in 2014.

While the failure of austerity policy in recent years seems to be gradually impinging on the position of the European Commission, the French government is persisting along its same old path. In the face of the social emergency that the country is facing and the paradigm shift that seems to be taking hold in most international institutions, the French government is choosing to stick to its 3% fetish.

[1] iAGS stands for the Independent Annual Growth Survey. This is a simplified model of the eleven main economies in the euro zone (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal and Spain). For more detail, see the working document Model for euro area medium term projections.