By Christophe Blot and Paul Hubert

The Covid-19 crisis will inevitably plunge the global economy into recession in 2020. The first available indicators – an increase in the unemployment rolls and in partial unemployment – already reveal an unprecedented collapse in activity. In France, the OFCE’s assessment suggests a 32% cut in GDP during the lockdown. This fall is due mainly to stopping non-essential activities and to lower consumption. The shock could, however, be amplified by other factors (including rises in some sovereign rates, falling oil prices, and capital and foreign exchange movements) and in particular by the financial panic that has spread to the world’s stock exchanges since the end of February.

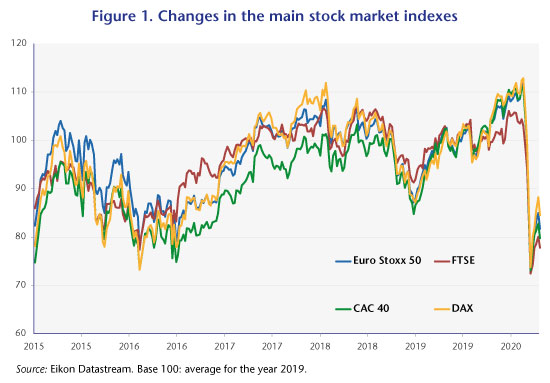

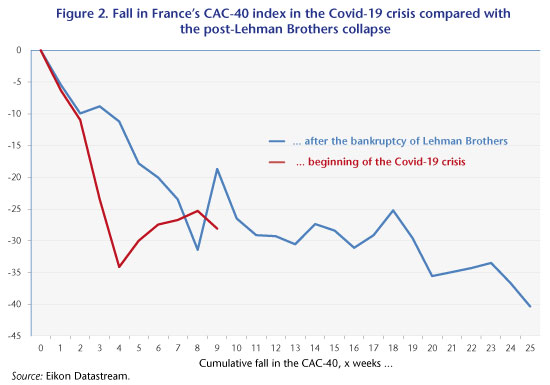

Since 24 February 2020, the first precipitous one-day fall, the main stock indexes have begun a decline that accentuated markedly in the weeks of March 9 and 16, despite announcements from the Federal Reserve and then the European Central Bank (Figure 1). As of 25 April, France’s CAC-40 index had fallen by 28% (with a low of -38% in mid-March), -25% for the German index and nearly -27% for the European Eurostoxx index. This stock market crash could revive fears of a new financial crisis, only a few years after the subprime crisis. The fall in the CAC-40 in the first few weeks was in fact steeper than that observed in the months following the collapse of Lehman Brothers in September 2008 (Figure 2).

While the short-term impact of the Covid-19 crisis could prove to be more severe than that of the 2008 financial crisis, the origin of the crisis is very different – hence the need to reconsider the impact of the stock market panic. In the financial crisis, the origin was in fact a banking crisis, fuelled by a specific segment of the US real estate market, the subprime market. This financial crisis then caused a drop-off in demand and a recession through a variety of channels: higher risk premiums, credit rationing, financial and real estate wealth effects, uncertainty, and so on. While some of these elements can be found today, they are now being interpreted as the consequence of a health crisis. But if there is no doubt that this is at the outset a health and economic crisis, can it trigger a stock market crash?

Another way of posing the question is to ask ourselves whether the current stock market fall is due entirely to the economic crisis. Share prices are in fact supposed to reflect future changes in a company’s profits. Therefore, expectations of a recession, as demand – consumption and investment – and supply are constrained, must result in a reduction in turnover and future profits, and therefore a fall in share prices.

However, the financial shock could be magnified if the fall in stock prices is greater than that caused by the decline in corporate profits. This is a thorny issue, but it is possible to make an assessment of a possible over-adjustment of the stock market, and thus of a possible financial amplification of the crisis. The method we have used is to compare changes in profit expectations (by financial analysts) since the beginning of the Covid-19 crisis with the fall in equities. Focusing on CAC-40 companies, profit expectations for next year have been cut in the last three months by 13.4% [1]. This reduction should therefore be fully reflected in the change in the index. In fact, the fall there was much larger: -28%. This would result in an amplification of the financial shock by just under 15 percentage points.

This over-adjustment by the stock market can be explained by, among other things, the current prevailing uncertainty about the way lockdowns around the world will be eased, and thus about an economic recovery, as well as uncertainty about the oil shock that is unfolding concomitantly, with determinants that are both economic and geopolitical. This over-adjustment may therefore not be wholly irrational (with regard to the supposed efficiency of financial markets), but the fact remains that it has led to major variations in the financial assets of consumers and business.

Variations like these are not neutral for economic growth. On the consumer side, they contribute to what are called the wealth effects on consumption: additions to a household’s assets give it a sense of wealth that drives it to increase its consumption [2]. This effect is all the greater in countries where household assets are in the main financialized. If a large portion of household wealth is made up of equities, then changes in share prices strongly influence this wealth effect. The portion of shares (or of investment funds) in financial assets is quite similar in France and the United States, respectively 27% and 29%. However, these assets account for a much larger share of the disposable income of American households: 156%, compared to 99.5% in France. As a result, French households are less exposed to changes in share prices. Empirical studies generally suggest a greater wealth effect in the United States than in France [3].

As for business, these changes in stock market valuations have an effect on investment decisions through collateral constraints. When a company takes on debt to finance an investment project, the bank demands assets as collateral. These assets can be either physical or financial. In the event of an increase in equity markets, a company’s financial assets increase in value and allow it greater access to credit [4]. This mechanism is potentially important today. At a time when companies have very large cash requirements to cope with the brutal shutdown of the economy, the sharp decline in their financial assets is restricting their access to lines of credit. While the financial amplification factors are not reducible to the financial shock, the recent changes in the prices of these assets are nevertheless giving an initial indication of how the financial system is responding to the ongoing health and economic crises.

[1] The data comes from Eikon Datastream, which for each company provides analysts’ consensus on the earnings per share (EPS) for the coming year and the following year. We then calculated the weighted average using the weight of each CAC-40 company in the index of the change in these expectations over the past three months. The fact that a 13.4% decline in profit expectations for the next year will give rise to a 13.4% decline in the stock price is made on the assumption that profits beyond the next year are not taken into account, or, in other words, that their current net value is zero, which is to say that investors’ preference for the present is very strong today.

[2] More formally, we can speak of a propensity to consume that increases as wealth increases. Wealth effects can be distinguishable according to whether they are purely financial assets or also include property assets.

[3] See Antonin, Plane and Sampognaro (2017) for a summary of these estimates.

[4] See Ehrmann and Fratzscher (2004) and Chaney, Sraer and Thesmar (2012) for empirical assessments of this transmission channel via share prices or property prices, respectively.

Leave a Reply