by Christophe Blot, Jérôme Creel, and Paul Hubert

Five years after the ECB launched its asset purchase programme (APP), the Covid-19 crisis has put the ECB again at the center of euro area attention, with a new extension of APP and with the creation of the Pandemic Emergency Purchase Programme (PEPP). The simultaneity between APP’s extension and PEPP – they were decided within a two-week interval – could be interpreted as arising from the pursuit of the same objective. This interpretation may be misleading though and may bias the respective appraisal of these policies.

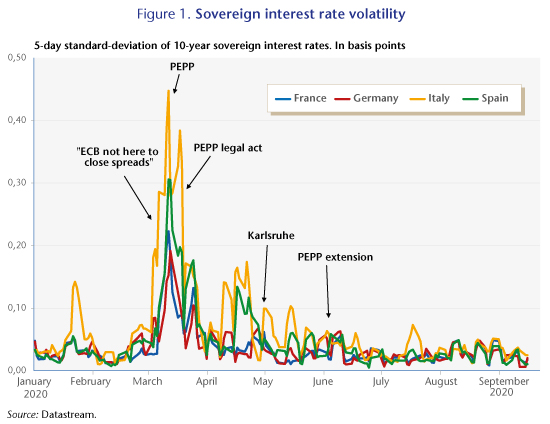

The APP arrived at a moment when the euro area was facing strong deflationary risks whereas the PEPP was implemented when the inflation outlook was unclear (because the Covid-19 crisis is a mix of a supply, demand and uncertainty shocks) but fragmentation risks were on the upside. Sovereign risks and increasing spreads could impair the transmission of monetary policy across euro area countries. The declared will by ECB officials to tackle the fragmentation of the euro area and the (temporary) removal of the self-imposed limits on asset purchases suggest that the ECB sets a sort of a “spread targeting” objective to the PEPP. We develop this argument in a recent Monetary Dialogue Paper for the ECON committee of the European Parliament. From the point of view of this “spread targeting” objective, the PEPP is successful with both the level and volatility of sovereign spreads at low levels (figure 1).

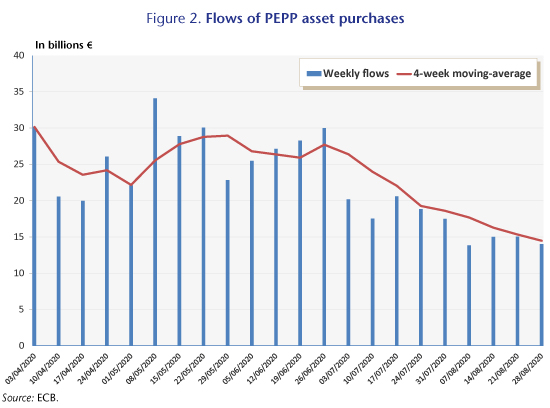

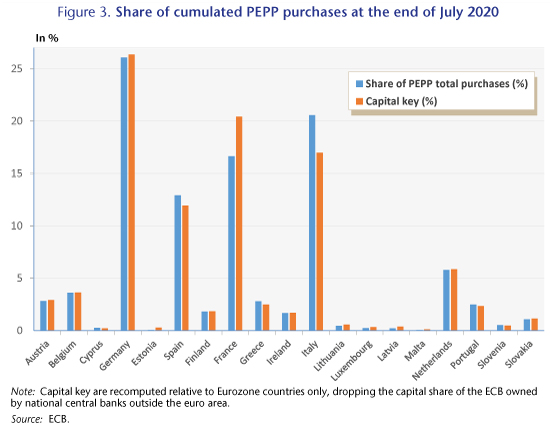

This outcome was obtained without a full utilisation of the potential resources of the PEPP. The weekly flow of purchases is even decreasing since July (figure 2). This suggests that the signaling effect of the PEPP has been strong and credible in taming sovereign stress. It also suggests that the ECB is not short of ammunitions if the crisis persists or intensifies. The outcome of the PEPP was also achieved without deviating much from the ECB capital key (figure 3), except for France (for which the ECB capital share exceeds bond purchases) and Italy (for which bond purchases exceed the share at the ECB capital exceeds).

The ruling of the German Federal Constitutional Court last May has revived discussions on the adequacy of asset purchases by the ECB.[1] Discussions have opposed those who think that the ECB has had “disproportionate” economic policy effects (on public debts, personal savings and the keeping afloat of economically unviable companies) and those who think that the distinction between the “monetary policy objective” and “the economic policy effects arising from the programme” is misleading. The reason is that this distinction seems to imply that achieving the objective of the ECB – inflation at the 2% target – can be achieved without interactions with other macroeconomic and financial variables, which is nonsense. Moreover, this distinction gives too much weight to the price stability objective during a real economic crisis at the expense of all the secondary objectives that the Treaty on the Functioning of the EU imposes to the ECB.

Finally, the success or

failure of a given policy must be assessed according to its objective(s). In

that respect, the PEPP, under the assumption that it aimed at reducing

sovereign spreads to avoid the fragmentation of the euro area, has been

effective. Although it may depart from the ECB mandate that does not explicitly

mention the reduction of sovereign spreads as a monetary policy objective, PEPP

has improved the transmission of monetary policy. In a situation where the

pandemic crisis requires a fiscal stimulus more than a fiscal consolidation and

where a rise in inflation or in real GDP is very unlikely, the accommodative

ECB monetary policy has been undeniably relevant to ensure public debt

sustainability in Europe and to remove the risk of a break-up of the euro area.

[1] It also revived discussions on the ability of the Bundesbank to continue to be involved in unconventional monetary operations. At the end of June 2020, the Bundestag pronounced itself in favour of the ECB and PEPP which, in the short term, removes the threat of an early end to monetary easing. This will however not prevent a further appeal by German plaintiffs against the ECB and, in the longer term, a new judicial episode.

Poster un Commentaire