By Lucrezia Reichlin, Giovanni Ricco, and Matthieu Tarbé

Abstract

Monetary policy – conventional or unconventional – has fiscal implications. By affecting interest rates, inflation and output, it relaxes or tightens the general government budget constraint. The effect on inflation is then the result of the combined action of monetary policy and the fiscal response to it via the adjustment of the primary deficit. In a recent paper, we estimate the fiscal responses to conventional and unconventional monetary policy in the four largest countries of the euro area. We find a positive primary deficit response to conventional short-term interest rate easing. In contrast to this fiscal-monetary coordination in the conventional case, fiscal responses to unconventional monetary policy easing are muted. They generate crosswinds, which is consistent with the more modest impact of unconventional monetary policy on inflation.

Inflation in the euro area as a joint fiscal-monetary phenomenon

The topic of coordination between monetary and fiscal policy has become the focus of policy discussion in recent years (Draghi, 2014, Lagarde, 2020, Schnabel, 2021). One reason is that there is limited space for traditional monetary policy based on steering the short-term interest rate when the latter is at or close to the effective lower bound (ELB). Many recent papers have advocated mechanisms to implement a coherent a monetary-fiscal policy mix (see for example the policy report by Barsch et al 2021).

Empirically, there is limited knowledge about how the combination of monetary and fiscal policy affects inflation. This is a complex topic since there are multiple channels of interaction. Monetary policy, by affecting interest rates, output and inflation has an impact on the government’s budget constraint. The response of fiscal authorities via the adjustment of the primary deficit depends on the fiscal framework or their stabilization objectives. The effect on inflation depends on the combined effects of fiscal and monetary actions as these affect the adjustment which is required to satisfy the intertemporal budget constraint of the consolidated government sector (central bank and governments). This is the consequence of the constraint being a binding identity which depends on inflation, returns on government debt and primary surpluses.

In the governance of the Euro Area (EA), the central bank is an independent institution and the treaties have delegated to it the responsibility for price stability. As a consequence, the budget constraints of the central bank and governments must be thought as separate ex-ante. However – ex-post – what matters to understand the dynamics of inflation is the consolidated budget constraint of the central bank and the nineteen fiscal authorities. Therefore, if we want to understand the causes of the under-shooting of the inflation target since 2013 in the European Monetary Union (EMU), we need to consider how primary deficits and returns have responded to monetary policy.

In a recent paper (Reichlin, Ricco, Tarbé, 2021) we estimated empirically the response of fiscal variables, inflation and the market value of government debt to monetary policy changes affecting the short-term rate (traditional policy) or long-term rates (forward guidance or quantitative easing). Beside estimating VAR-based impulse response functions, we used the intertemporal budget constraint identity to obtain a decomposition of unexpected inflation (conditional on monetary policy) into several components: the primary deficit, returns on the market value of government debt, and output growth. We modelled this relationship using euro area aggregate data and a newly constructed dataset for France, Germany, Italy and Spain.

Our framework is inspired by Hall and Sargent (1997) and Cochrane (2019, 2020). Common to their approach is to start from the general government intertemporal budget constraint as an equilibrium identity linking the market value of the debt to future discounted primary surpluses.

From that budget constraint, one can obtain a linearized identity that, in words, is of the following shape:

Inflation (impact) – Nominal Returns (impact) =

– (cumulated Surplus + cumulated Growth)

+ (cumulated future Nominal Returns – cumulated future Inflation),

where each term is to be thought of as an unexpected change.

The intuition is that an unexpected contemporaneous increase in inflation – if not matched by a movement in contemporaneous returns – has to correspond to either a decline in the (cumulated) surplus to GDP ratios, or a decline in cumulated GDP growth, or a rise in the discount rates[1]. These adjustments in the aggregate can happen as a combination of symmetric or asymmetric changes at the country level.

Since this identity involves bond returns, inflation and fiscal variables, it can be used to learn about the fiscal-monetary adjustment dynamics in an otherwise unrestricted empirical model.

To apply this framework to the euro area we need to extend it to the case of a single central bank and multiple fiscal authorities.

We focus on a stylised description of the EMU in which each country can issue debt and hence faces different market rates (and returns). Inflation at the euro area level is determined by the aggregate fiscal and monetary stance, and the aggregate fiscal stance is the sum of the fiscal positions of individual states that may or may not balance their budgets independently, and take inflation as given. Such a description is open to nuances such as divergences in the national inflation rates in the medium-run, and fiscal transfers across countries to help balancing out national fiscal imbalances. Whether such mechanisms operate or not is an entirely empirical matter.

Conventional monetary policy and the fiscal stance

We identify the shocks in the model using a combination of sign restrictions, as in Uhlig (2005), and the recently proposed narrative sign restrictions of Antolin-Diaz and Rubio-Ramirez (2018). In addition to traditional sign restrictions, we constrain an expansionary conventional monetary policy shock (MP) to have a negative impact on the short- and long-term interest rates, a positive impact on output, and a positive impact on inflation and inflation expectations for the first three quarters (inflation moving by a larger amount). We separately identify the MP and unconventional monetary policy shocks (UMP) based on their differential impacts on the yield curve. The MP shock is assumed to move short term interest rates by a larger amount than long term rates, leading to a steepening of the yield curve. The UMP shock has the opposite effect on the slope. We also assume that monetary policy shocks are neutral and do not affect real GDP, in the long-run.[2]

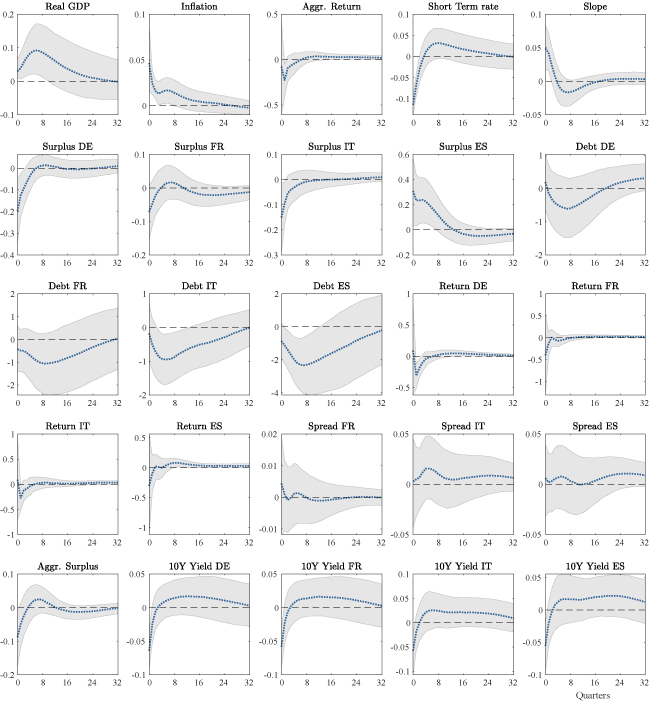

A first set of results pertains to conventional monetary policy (Figure 1). GDP and inflation respond as expected: there is a hump-shaped impact on GDP, peaking at about 0.1% in the second year, and an immediate impact on inflation and inflation expectations. In line with the transitory nature of the shock, the impact on long-term yields is both small in magnitude and short lived.

What is more interesting for our discussion are the responses of the fiscal variables. For the aggregate we estimate an immediate decline in the surplus-to-EA-GDP ratio which, as shown in Figure 1, is driven by France, Germany and Italy, whereas Spain responds with a surplus. The value of debt-to-EA-GDP ratio falls for all countries in the first two years, although there is a high degree of uncertainty in these estimates.

Figure 1 – Impulse response functions to a one standard deviation conventional monetary policy shock (easing) in the euro area

Note: The shock is a small cut in the short-term interest rate, of about 10 basis points. The impulse response of real GDP is reported in level, i.e. as percentage deviation from the steady state. All other impulse responses are reported as annualized percentage-point deviations from the steady state. For details on the quarterly data construction and which variables enter the estimation, see appendix B of Reichlin et al. (2021). Inflation and interest rates are in % (annualized). Slope is the German long-term interest rate minus the euro area short-term interest rate. Returns are nominal returns in % (annualized) on the portfolio of government debt, inferred from debt and surplus. Spreads are country long-term interest rates minus the German long-term interest rate. Debts are 400 times the logarithm of the following ratio: country debt over quarterly euro area GDP. Surpluses denote 400 times country primary surplus over quarterly euro area GDP, scaled by country debt over quarterly euro area GDP at steady state.

The response of the return on government debt is ambiguous since it is driven by both short- and long-term interest rate movements, while sovereign spreads do not appear to react significantly to the conventional MP shock, indicating a symmetric transmission across the euro area.

Long-term results (not shown here) point to a decomposition of unexpected inflation which is split by fiscal policy easing in the same direction as monetary policy and a relatively muted response of returns on the market value of the debt. As we will see in the next section, this contrasts with the response to unconventional monetary policy. These results have to be understood as indicative, since long-run estimates are necessarily imprecise due to the uncertainty in the assumptions on the level of the steady states.[3]

To summarise, we report evidence of fiscal-monetary coordination conditional on a conventional monetary policy easing: in response to the decline in interest rates, the fiscal authorities allow the surplus-to-EA-GDP ratio to decline. The overall impact of the policy is an increase in output, an increase in inflation, and an insignificant decline in the debt-to-EA-GDP ratio.

This is not the case for an unconventional monetary policy easing driving long-term interest rates down.

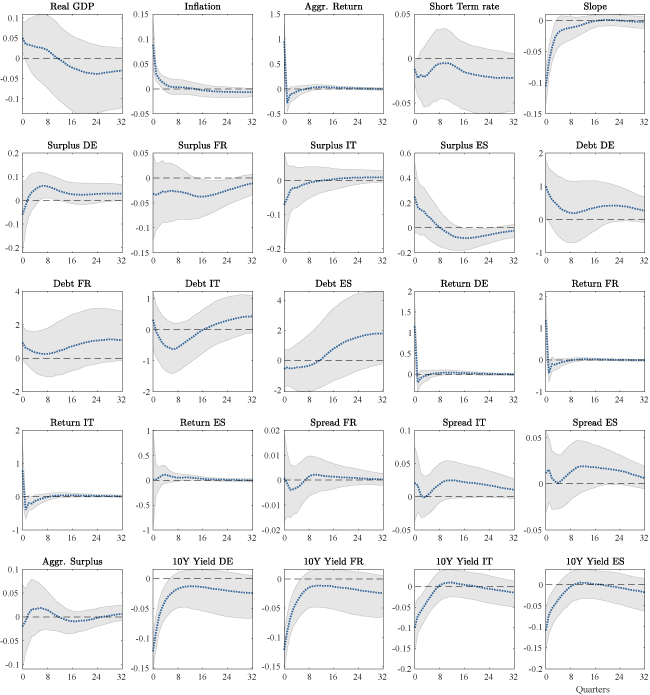

Unconventional monetary policy and crosswinds

A second set of results is reported in Figure 2, for unconventional monetary policy. We observe a small positive reaction of output and a sizable response of inflation on impact, yet both effects are less persistent than in the case of a conventional shock. The effect on the surpluses is negligible and not significant. While the value of the debt increases on impact for some countries, the response is not significant beyond the first period. This is associated with an unambiguous response in the returns on government debt, which explains this increase in the market value of the debt in Germany and France.

Figure 2 – Impulse response functions to a one standard deviation unconventional monetary policy shock (easing) in the euro area

Note: A one standard deviation shock corresponds to a 10 basis points decline in the long-term yield. The impulse response of real GDP is reported in level, i.e. as percentage deviation from the steady state. All other impulse responses are reported as annualized percentage-point deviations from the steady state. For details on the quarterly data construction and which variables enter the estimation, see appendix B of Reichlin et al (2021). Inflation and interest rates are in % (annualized). Slope is the German long-term interest rate minus the euro area short-term interest rate. Returns are nominal returns in % (annualized) on the portfolio of government debt, inferred from debt and surplus. Spreads are country long-term interest rates minus the German long-term interest rate. Debts are 400 times the logarithm of the following ratio: country debt over quarterly euro area GDP. Surpluses denote 400 times country primary surplus over quarterly euro area GDP, scaled by country debt over quarterly euro area GDP at steady state.

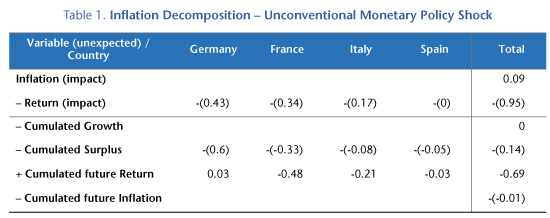

Let us now show results for the inflation decomposition in the long-run:

Unexpected inflation decomposition in terms of changes to returns and future cumulated changes to growth, surplus, returns and inflation. The country columns display numbers weighted by country shares. For details on the quarterly data construction and which variables enter the estimation, see appendix B of Reichlin et al (2021). Inflation is in % (annualized). Returns are nominal returns in % (annualized) on the portfolio of government debt, inferred from debt and surplus. Surpluses denote 400 times country primary surplus over quarterly euro area GDP, scaled by country debt over quarterly euro area GDP at steady state.

The unexpected inflation decomposition reported in the table shows that the 10 basis points (bps) decline in the long-term rate due to the unconventional monetary policy shock corresponds to a large adjustment in the nominal returns, which jump by 95 bps in the short run and then contract by 69 bps in the future. Overall inflation movements are muted, about a half of what is seen in the case of conventional monetary policy. We have a jump by 9 bps in the short run, and then a cumulated decline by 1 bps in the future. Thus, the real discount rate term is -68 bps. While in the case of conventional monetary policy we have seen a cumulated deficit in the long-run, here we have a cumulated primary surplus to GDP ratio response of 14 bps, generating crosswinds in the aggregate. This long-run finding is mainly to be attributed to Germany.

The muted fiscal response conditional on an UMP shock is telling us that when that policy was active, i.e. since the 2008 crisis (first via targeted loans, then via forward guidance and asset purchases), fiscal authorities did not use the fiscal space afforded by the decrease in long-term rates. The response of the primary surplus to a monetary policy easing is insignificant in the short-run and overall positive in the long-run, unlike in the case of conventional policy (negative both at business cycle frequency and in the long-run).

These results come with two warnings. First, as we have seen, estimates are quite imprecise. Second, long run results are also sensitive to assumptions on the steady state, as already commented. This is a problem hard to address given the short sample and the evolving policy landscape.

To sum up, in contrast with the conventional monetary policy case, the response of inflation and output is muted, and there is no fiscal expansion.

Conclusions

In the euro area the empirical fiscal-monetary mix appears to vary depending on the conventional (i.e. affecting the short-term interest rate) or unconventional (i.e. shifting the long end of the yield curve) nature of the monetary policy shock.

Key in this difference are two factors: (i) the movement of the returns on the value of the debt, which depends on the change in yields at the relevant maturity, and (ii) the response of the primary surplus, which depends on fiscal policy.

Nonstandard monetary policy has a much larger effect on returns since, given the average debt maturity, long-term yield changes have a higher impact on returns than changes in the short-rate. The long-run price level is lower than in the conventional policy case, while the primary surplus response is muted and slightly positive in the long-run.

The interpretation of this result is as follows: when unconventional monetary policy was implemented – post financial crisis – the combination of high legacy debt and fiscal rules constrained the fiscal response, determining a situation in which the monetary and fiscal authorities worked against one another.

Paradoxically, when the economy was at the ELB, in a situation in which fiscal policy is more powerful than monetary policy, the responsibility for stabilization fell on the shoulders of monetary policy alone.

References

Antolin-Diaz, Juan and Juan Francisco Rubio-Ramirez, “Narrative Sign Restrictions for SVARs, » American Economic Review, October 2018, 108 (10), 2802-29.

Bartsch, Elga, Agnès Bénassy-Quéré, Giancarlo Corsetti, Xavier Debrun “It’s All in the Mix: How Monetary and. Fiscal Policies Can Work or Fail Together”. Geneva Reports on the World Economy 23, 2021.

Cochrane, John H, “The fiscal roots of inflation, » Technical Report, National Bureau of Economic Research 2019.

Cochrane, John H., “The Fiscal Theory of the Price Level”, Unpublished, 2020.

Draghi, Mario, “Unemployment in the euro area, » Speech by Mario Draghi, President of the ECB, Annual central bank symposium in Jackson Hole, European Central Bank 2014.

Hall, George J. and Thomas J. Sargent, “Interest rate risk and other determinants of post-WWII US government debt/GDP dynamics, » American Economic Journal: Macroeconomics, 2011, 3 (3), 192-214.

Lagarde, Christine, “Monetary policy in a pandemic emergency, » Keynote speech by Christine Lagarde, President of the ECB, at the ECB Forum on Central Banking, European Central Bank 2020.

Reichlin, Lucrezia and Ricco, Giovanni and Tarbé, Matthieu, Monetary-Fiscal Crosswinds in the European Monetary Union (May 1, 2021). CEPR Discussion Paper No. DP16138.

Schnabel, Isabel, “Unconventional fiscal and monetary policy at the zero lower bound, » Keynote speech by Isabel Schnabel, Member of the Executive Board of the ECB, at the Third Annual Conference organised by the European Fiscal Board on “High Debt, Low Rates and Tail Events: Rules-Based Fiscal Frameworks under Stress », European Central Bank 2021.

Uhlig, Harald, “What are the effects of monetary policy on output?

Results from an agnostic identification procedure, » Journal of Monetary

Economics, March 2005, 52 (2), 381-419.

[1] Cochrane (2019) then further decomposes the contemporaneous nominal return term, between a future inflation term and a future real discount rate term, by assuming a geometric maturity structure. Unexpected inflation has to correspond to a decline in expected future surpluses, or a rise in their discount rates.

[2] We complement the restrictions on impulse responses with narrative sign restrictions, following Antolin-Diaz and Rubio-Ramirez (2018). In particular we assume that: (i) a contractionary (negative) conventional monetary policy shock happened on the third quarter of 2008 and the first quarter of 2011, and it was the single largest contributor to the unexpected movement in the short-term interest rate during those two periods; (ii) an expansionary (positive) unconventional monetary policy shock took place on the first quarter of 2015, and it was the single largest contributor to the unexpected movement in the term spread between the German long-term interest rate and the short-term interest rate during that period.

[3] Our steady state assumptions are consistent with the debt-to-Euro-Area-GDP ratios of each of the countries being equal to their historical average, and the primary surpluses being zero in the long run. We also impose that the steady state inflation rate is equal to 1.9%, `below but close to 2%’ as specified by the ECB’s inflation objective. For real GDP growth, we fix the steady state at 1.5%, close to the sample average. Consistent with our choice for the steady state surplus, we fix the steady-state returns on the government debt portfolio at

.

Finally, the short-term real interest rate is assumed to be 1% in steady state, the spread between the long- and short-term interest rates to be 100 basis points, the sovereign spread to be 50 basis points for France, and 100 basis points for Italy and Spain.

Poster un Commentaire