By Hervé Péléraux

According to the OFCE’s leading indicator, the French economy has grown by 0.5% in the fourth quarter of 2013. This result, which was anticipated, reflects the improvement in business surveys seen for about a year now. However, does this mark the return of GDP to a path of higher long-term growth? It is still too early to say.

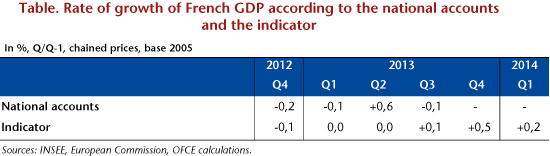

The improvement in the business surveys anticipated the interruption in the second recession that took place in the first half of 2011. The national accounts then validated the signal emitted by the surveys, with renewed growth of 0.6% in the second quarter of 2013 (Table). GDP did of course fall again in the third quarter (-0.1%), but on average over the last two quarters there was growth of approximately 0.2% per quarter, a rate that, though very moderate, was still positive.

At the same time, the leading indicator, which aims to arrive at an estimate of GDP growth in the very short term by translating the cyclical information contained in the surveys, also pointed to a slow recovery in activity: on average over the last two quarters, growth was estimated at 0.1%, a figure that is slightly under the assessment of the national accounts.

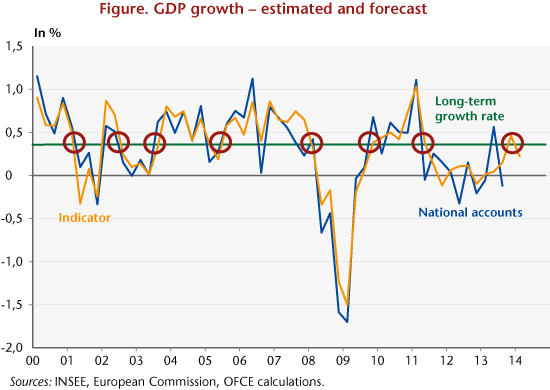

In the last few months, the uncontested growth in the confidence of private agents has enhanced the outlook for the end of 2013: the debate is now focusing on the possibility for the French economy to break through a turning point upwards and for growth to settle in at a level higher than the pace of long-term growth (0.35% per quarter).

Based on past experience, when the indicator has sent out warning signs of a turning point in the economic cycle, the signal issued for the fourth quarter of 2013 is indicating that the long-term growth rate of the French economy is being crossed (Figure). This signal is fragile: the still very partial information on the first quarter of 2014, i.e. the business surveys for January, point towards the growth rate falling below its potential. The possibility of a real lasting recovery that is able to create jobs and reverse the trend in unemployment is thus still very uncertain.

____________________________________________________________________________________

Note on the leading indicator:

The leading indicator aims to forecast the quarterly growth rate for French GDP two quarters beyond the latest available data. The components of the indicator are selected from survey data sets that are rapidly available and unrevised. The selection of the data series is made on an econometric basis, starting from the business surveys carried out in different productive sectors (industry, construction, services, retail) and among consumers. Two series related to the international environment are also significant: the rate of growth of the real exchange rate of the euro against the dollar, and the real growth rate of oil prices.

Some components are at least two quarters in advance and as such can be used to predict GDP growth. Others are coincidental, or are not sufficiently advanced to make a forecast two quarters ahead. These series need to be forecast, but over a short-term horizon that never exceeds four months.

The leading indicator is calculated at the beginning of each month, shortly after the publication of the business and consumer surveys.